Trusts in the UK: How the Wealthy Protect Their Money (And Why You Should too)

Last updated on February 16th, 2026 at 09:16 pm

What Is a Trust in the UK?

A trust is one of the smartest ways to protect your assets and guide how they’re passed on. In simple terms, trusts in the UK are legal arrangements that let you (the settlor) hand over assets, like property, money, or investments, to trusted people (trustees) to manage for someone else (beneficiaries).

Think of it as a protective box for your wealth, one that follows your rules, keeps your loved ones secure, and can even help reduce future tax burdens.

You still control the rules, but the box is guarded by trustees who must follow your instructions, even after you’re gone.

Why Trusts Exist (and Why Most People Don’t Use Them Until It’s Too Late)

Most people hear the word trust and picture posh lawyers in pinstripes or billionaires sipping coffee over inheritance plans. But trusts aren’t just for the ultra-rich; they’re for anyone who wants control, protection, and peace of mind over what happens to their hard-earned money.

Let’s put it plainly:

A trust lets you say, “This money is for my daughter’s university fees, but she can’t blow it on Ibiza trips at 19.”

Or, “This flat stays in the family, no divorces, debts, or dodgy partners can touch it.”

It’s the financial version of child locks, and they’re useful even if you’re not sitting on millions.

The Three Key Roles (and How They Work Together)

• Settlor – You, the one who sets it up and decides the rules.

• Trustee(s) – The people who manage the assets according to your wishes.

• Beneficiaries – The people who benefit from it (your kids, partner, charity or anyone you choose).

Imagine you’re the writer of a play. The trustees are the stage managers keeping things in order, and the beneficiaries are the audience who get to enjoy the show.

Types of Trusts in the UK (And When They Make Sense)

There are many, but here are the main ones most families come across:

1. Bare Trust – Simple and Straightforward

Used when you just want to hold assets for someone until they’re old enough to manage them.

Example:

You open a bare trust for your son, age 8, with £10,000 in it. When he turns 18, he gets the money….simple as that.

2. Discretionary Trust – Flexibility and Control

Trustees decide how and when to distribute the money based on your wishes.

Example:

A grandmother sets up a discretionary trust for her two grandchildren. One might get help with university, another with buying a home, depending on their needs.

3. Interest in Possession Trust – Regular Income for Someone

Someone gets the income from assets, but not the assets themselves.

Example:

A husband passes away and leaves a trust giving his wife the rental income from a property for life, but after she dies, the property passes to their children.

4. Property or Life Interest Trust – Often Used in Wills

Keeps property safe within the family line while allowing a surviving spouse to live there.

Example:

You own a house worth £400,000. You leave your half in a trust so your partner can stay there for life, but your share eventually passes to your children.

Real-Life Scenarios: From Modest Means to Millionaires

Scenario 1: The Everyday Saver

Amira, a nurse from Birmingham, owns her home outright. She worries her grown son might sell it under pressure one day. Her solicitor helps her place the property in a life interest trust. Amira can live there until she dies, then the house goes directly to her grandchildren, no waiting, no inheritance squabbles.

Scenario 2: The Growing Entrepreneur

Aaron runs a small catering business. Over time, he’s built up savings, a van, and some investments. Rather than risking these being lost if he’s ever sued, he puts certain assets into a discretionary trust. That way, even if business troubles arise, his family’s nest egg is ring-fenced.

Scenario 3: The High-Net-Worth Planner

Sophie and Daniel own multiple rental properties and a large investment portfolio. Their financial planner creates a family trust to reduce inheritance tax and manage how wealth is passed down. They keep flexibility: income goes to their kids for education, while capital stays invested.

Different levels, same principle, protection, planning, and peace of mind.

Why Trusts Matter (Even If You’re Not Rich)

Here’s the secret the wealthy already know: it’s not about how much you have; it’s about how well you protect it.

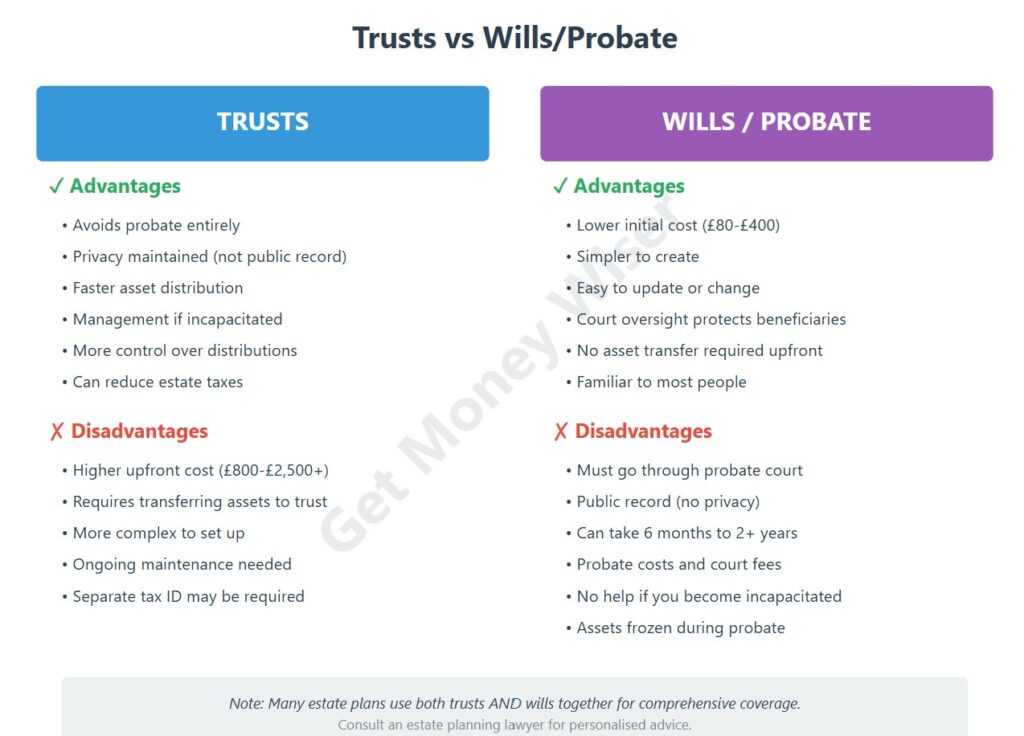

• Avoid probate delays – assets in a trust usually bypass the slow, costly probate process.

• Protect vulnerable loved ones – children, disabled relatives, or anyone who might struggle to manage money.

• Reduce inheritance tax (IHT) – certain trusts can help manage or lessen future tax bills.

• Control how assets are used – you decide when and how beneficiaries receive money.

• Keep family wealth within family lines – protect against divorces or external claims.

A trust is like fitting an alarm system to your financial house, you hope you’ll never need it, but you’ll sleep better knowing it’s there.

Common Myths About Trusts

⚠ “Trusts are only for the rich.”

No. Many middle-income families use trusts for children’s savings or homes.

⚠ “You lose control of your assets.”

Partly true, you hand over legal ownership, but you decide the rules.

⚠ “They’re complicated and expensive.”

They can be, if you try to DIY it or use the wrong kind. Simple trusts often cost less to set up than you’d think, especially compared to the potential tax and legal costs of not having one.

How to Set Up a Trust (Step-by-Step)

Step 1: Clarify Your Goal

Is it to protect your home, support children, reduce tax, or create an income stream? Your reason shapes the type of trust.

Step 2: Get Proper Advice

Speak with a solicitor or estate-planning specialist who understands trusts in the UK (or your location). Ask about setup costs, ongoing management, and tax implications.

Step 3: Choose Your Trustees Wisely

Pick people (or professionals) you trust implicitly, they’ll manage assets on your behalf.

Step 4: Draft a Trust Deed

This legal document outlines the rules: what’s in the trust, who benefits, and under what conditions.

Step 5: Register the Trust

Most trusts in the UK must be registered with HMRC’s Trust Registration Service (TRS). Your adviser can handle this.

Step 6: Review Regularly

Life changes, so should your trust. Review it every few years, especially after big events (marriage, divorce, new children, buying a property, etc.).

When to Get Help (and What to Ask)

Before you meet an adviser, have these questions ready:

• What type of trust best suits my situation?

• What taxes might apply when setting it up or taking money out?

• What ongoing costs or admin should I expect?

• How does this fit with my will or estate plan?

Professional guidance can help you avoid pitfalls, like accidentally triggering inheritance or income tax you didn’t expect.

Final Thoughts from the Field

People who plan with trusts rarely regret it; people who don’t often wish they had.

You don’t need a castle or a Cayman account to think about legacy, just foresight.

A trust says, “I care about what happens after me.”

So whether you’re a first-time homeowner or sitting on multiple properties, take the time to learn, plan, and protect.

Because in the game of money, the players who last longest aren’t just the ones who earn big—they’re the ones who think ahead.

Uncle Abundance’s closing words:

“Money isn’t just about what you make—it’s about what you keep and what stays protected long after you’ve gone.”

Kettle’s on.