The Hidden Costs of Trading: What Your Platform Doesn’t Tell You

Last updated on February 16th, 2026 at 09:15 pm

Disclaimer: This article is for educational purposes only and is not financial advice. Always do your own research or speak to a licensed adviser before making financial decisions.

The Hidden Costs of Trading: What Most Beginners Never See

The hidden costs of trading are the quiet charges that drain your profits without you noticing. Every platform advertises “zero commissions” or “trade for free,” but once you look under the bonnet, the real expenses appear — spreads, swaps, slippage, funding fees, conversion fees, and more.

If you’ve ever wondered why your trading results don’t match your strategy, these hidden costs of trading are often the reason. And once you understand them, you instantly become a more informed and more profitable trader.

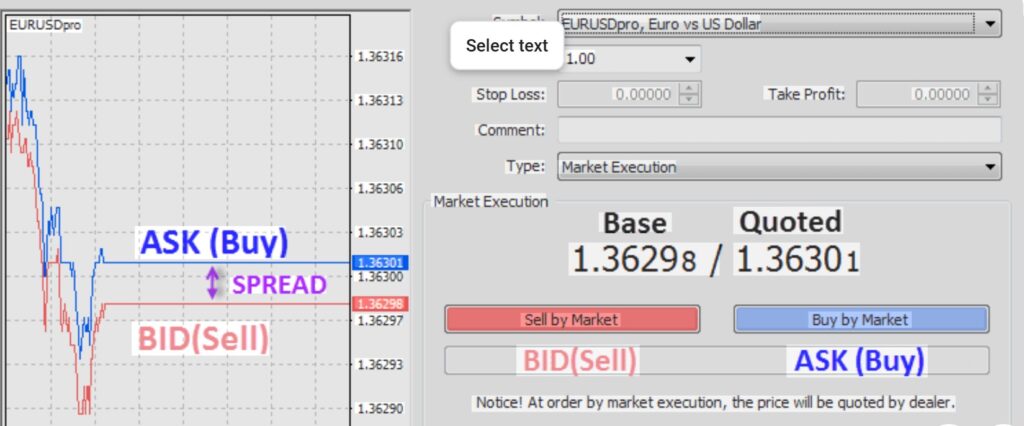

1. Spreads: The First Hidden Cost of Trading

Even when brokers claim “free trading,” they always include spreads — the gap between the buy and sell price.

This is one of the biggest hidden costs of trading because you pay it every single time, whether you win or lose.

- Tight spreads? Good.

- Widening spreads during volatility? Expensive.

- “Zero spread” accounts? Often offset with higher commissions.

🧭 Tip: Compare spreads during busy and quiet periods — some brokers widen them aggressively around news.

External reference: FCA’s guidance on trading costs and best execution.

2. Commissions: The Obvious Cost That Adds Up Quietly

Some brokers charge a flat fee per trade or per lot. Even £3 per trade can stack up quickly if you trade actively.

The key is not looking at commissions trade by trade — but total cost at the end of each week or month.

That reality check often surprises traders.

3. Slippage: The Hidden Cost Caused by Delay

Slippage is one of the most painful hidden costs of trading because it attacks your entries and exits.

You click buy at 1.2500 but get filled at 1.2504.

Or you close a trade in profit, only to receive a worse price than expected.

This happens due to:

- Volatile markets

- Slow execution

- Poor liquidity

- Delay on the broker’s side

Tip: Limit orders reduce slippage — especially during major news events.

4. Overnight Financing (Swaps): The Silent Daily Deduction

Hold a leveraged position past midnight?

You get charged swap/rollover interest.

This is one of the hidden costs of trading that shocks beginners the most — especially in a high-interest-rate environment.

Some swaps are tiny.

Some, especially on exotic pairs or indices, are painful.

Always check your broker’s “financing costs” page.

5. Currency Conversion Fees: Quiet but Costly

If your account is in GBP but the instrument trades in USD, every conversion has a fee.

Some brokers add a tiny markup that looks harmless but builds over time.

Look for:

Wallets that let you hold different base currencies

Multi-currency accounts

6. Platform Add-Ons and Premium Tools

Most traders don’t budget for this.

Premium charting, advanced indicators, depth-of-market data, and algorithmic add-ons all come with subscription fees.

Only pay for tools that genuinely help you make better decisions.

7. Withdrawal Fees and Inactivity Charges

These are the hidden costs of trading nobody expects.

Some brokers charge:

- £5–£15 per withdrawal

- Monthly fees if you don’t trade for a while

- Dormant account charges after long inactivity

These charges don’t appear in big banners — they sit deep in the terms and conditions.

The Hidden Costs Checklist

✅ Spreads — how wide and how often they change.

✅ Commissions — per trade or per volume?

✅ Slippage — what’s the average execution speed?

✅ Overnight swaps — do they apply to your positions?

✅ Currency conversions — any extra markup?

✅ Add-on tools — what’s genuinely useful?

✅ Withdrawal/inactivity fees — when do they kick in?

👉 Next step: Visit our Forex Broker Reviews at TopFinancialChoices.com to see which platforms are transparent, affordable, and FCA-regulated.

Disclaimer: We strive to provide accurate and up-to-date information, but financial markets change quickly. Always verify fee structures with official broker websites or regulators such as the FCA.

Final Thoughts from Uncle Abundance

Trading is like running a business — your profits depend not only on what you make, but on what you keep. And the hidden costs of trading? They’re like slow leaks in a tyre. Ignore them, and the journey becomes harder than it needs to be.

Once you know where the money escapes, you can finally stop the leaks and trade with clarity.

“The fine print never lies — it just waits for you to read it.”

Kettle’s on.